- Prime Minister Narendra Modi inaugurates Aero India 2023 in Bengaluru; Releases Commemorative Stamp

- Defence Secretary meets delegations from Saudi Arabia, USA and Oman on the sidelines of Aero India 2023

- Foreign Ministers of 32 countries to attend Aero India 2023

- Embraer showcases the C-390 Millennium at Aero India 2023

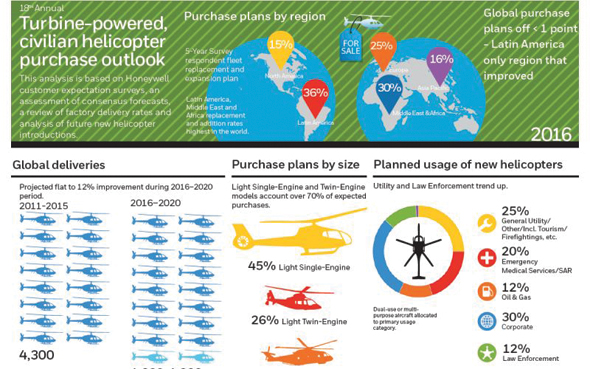

Honeywell forecasts lowers global helicopter deliveries

In the face of a slower global economic growth environment and increased volatility in oil and gas-related markets, the helicopter industry is reacting with a cautious outlook for near-term new purchases. In its 18th annual Turbine-Powered Civil Helicopter Purchase Outlook, Honeywell forecasts 4,300 to 4,800 civilian-use helicopters will be delivered from 2016 to 2020, roughly 400 helicopters lower than the 2015 five-year forecast.

Key global findings in the outlook include:

The survey showed new purchase-plan rates were stable, but operators cited fewer total new model purchases over the five-year period, leading to a more cautious near-term outlook. When considering a new purchase, operators’ results mirrored those from last year, with make and model choices for their new aircraft most strongly influenced by range, cabin size, performance, technology upgrades and brand experience. Helicopter fleet utilisation generally declined compared with last year. Over the next 12 months, usage rates are expected to improve but at a reduced rate.

Helicopter Use Expected to Increase

Helicopter fleet utilisation reported in the survey generally declined compared with last year. Over the next 12 months, usage rates are expected to increase but at a reduced rate, as the gap between operators planning increases and those planning decreases has narrowed in every region.

BRIC countries such as

Demand continues to ebb and flow with stronger results recorded for India and Brazil in the 2016 survey. In India and Brazil, new helicopter purchase-plan rates exceed the world average by a wide margin. Planned Chinese purchase rates slipped, reflecting near-term slower economic growth prospects. Notably, no Chinese-built models received specific purchase interest mentions in the survey; however, civil deliveries are occurring and are reflected in the Honeywell outlook.